| West Sussex |

|

Comyn & James |

The UK housing market starts autumn with momentum following a post-lockdown mini-boom, making summer 2020 busier than usual. Buyer demand has soared, up 34% on a year ago according to Zoopla, while supply to the marketplace is at its highest level since March 2008, according to Rightmove. Over 81,000 property sales were recorded in August, which is up 15.6% on July, with competition in the market leading to one in eight properties selling at or above asking price. Larger properties and those with gardens are proving immensely popular, with the impact of COVID-19 set to have a lasting change on our home and work lifestyles. Price growth is strongest across the East Midlands and the North West, but across all regions the trajectory is positive.

Both the economy and consumer confidence have both shown signs of improvement throughout the summer. The economy grew by 6.6% in July (ONS), however it remains over 11% lower than pre-lockdown, while consumer sentiment continues to rise, albeit slowly. Recovery remains cautious as the government grapples with balancing the economy and public health. Stamp duty holidays across the nations offer a saving for many buyers, however, while interest rates remain low, a reduction in high loan-to-value lending products is impacting first-time buyers.

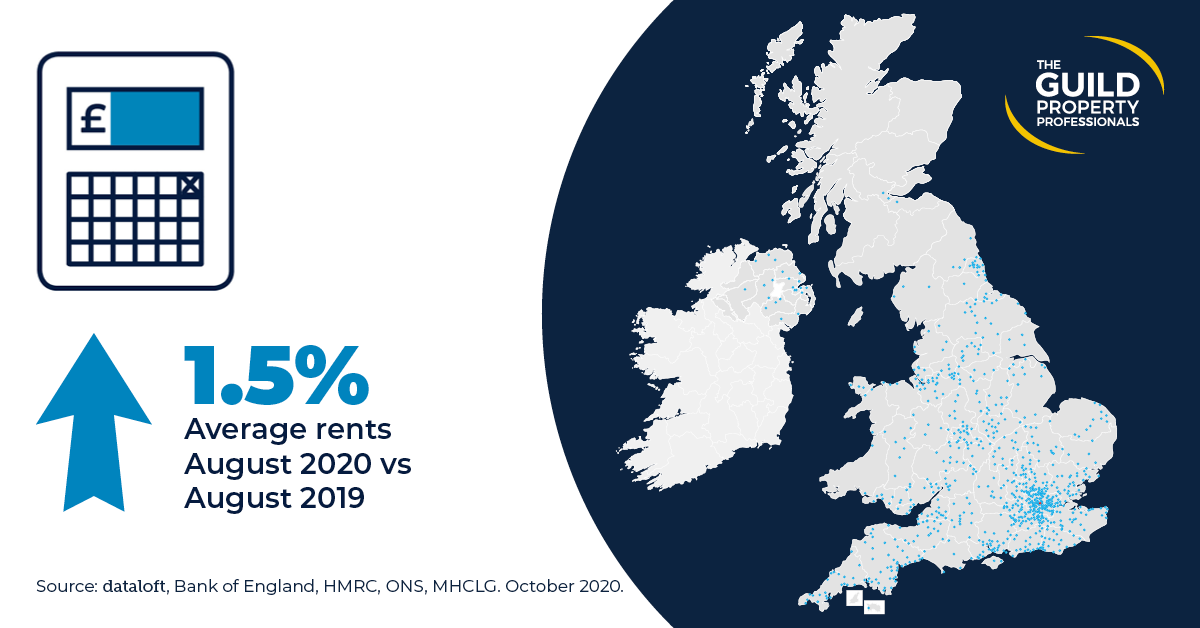

In the lettings market, as with the sales sector, demand for rental property increased over the summer, although new instructions remain muted, a continuation of the pre-lockdown trend. Average rental values across the UK rose by 1.5% in the year up to August, and yields remain attractive. Increased demand and a shortage of supply in many areas should help underpin rental values over the coming months. Just 13% of tenancies expire during the final quarter of the year but landlords will be keen to avoid unnecessary void periods.

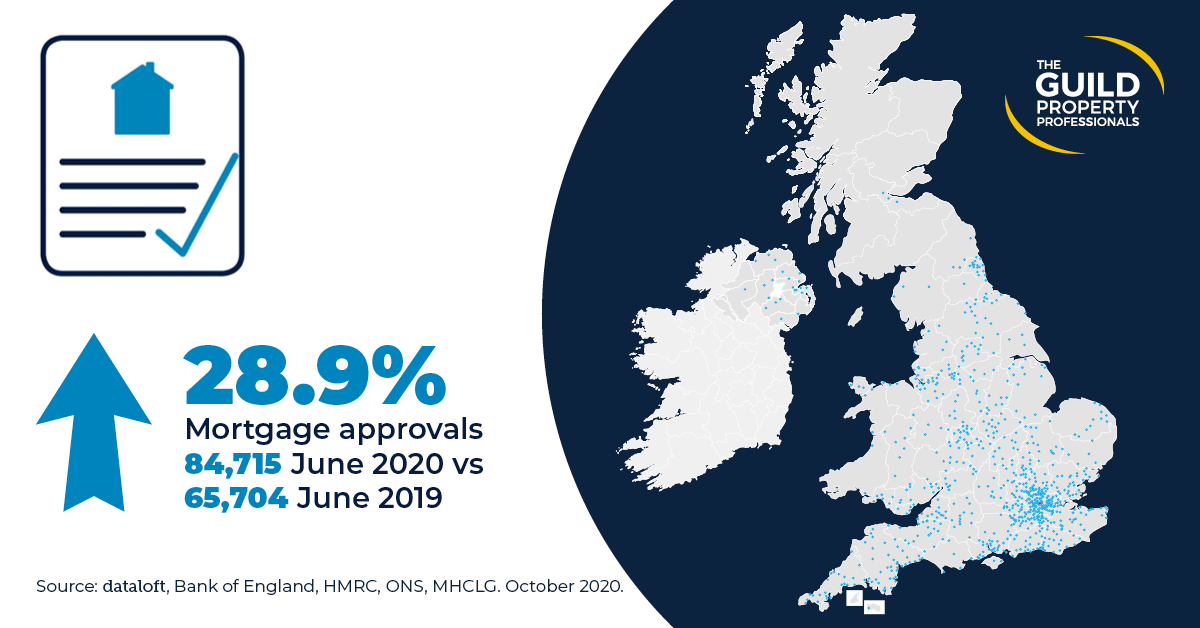

Properties are selling quicker than they did a year ago, and latest mortgage approvals suggest the market is returning to more ‘normal’ levels. However, the forced pause in the housing market means 2020 sales levels will no doubt end below those of 2019. UK house price growth is at its highest level in over two years and revised forecasts anticipate property prices will end the year 2% higher, a significant reversal to the negative expectations anticipated as the market reopened. Interest rates are predicted to be held at 0.1% until 2022.

Browse our Regional Market Reports:

● Market Report 2020 Autumn South West

● Market Report 2020 Autumn East Midlands

● Market Report 2020 Autumn Essex, Norfolk and Suffolk (East)

● Market Report 2020 Autumn Hertfordshire, Bedfordshire and Cambridgeshire (East)

● Market Report 2020 Autumn London

● Market Report 2020 Autumn North East and Yorkshire

● Market Report 2020 Autumn North West and North Wales

● Market Report 2020 Autumn Northern Ireland

● Market Report 2020 Autumn Scotland

● Market Report 2020 Autumn South East Home Counties - Kent and East Sussex

● Market Report 2020 Autumn Southern Home Counties - Surrey and West Sussex

● Market Report 2020 Autumn Southern

● Market Report 2020 Autumn Thames Valley, Berkshire, Oxfordshire and Buckinghamshire

● Market Report 2020 Autumn West and South Wales

● Market Report 2020 Autumn West Midlands and Wales

To see a full copy of The Guild’s autumn market report and for further guidance on the home moving process, take a look at the regional property market updates or get in touch with your local Guild Member today.

| West Sussex |

|

Comyn & James |

| London |

| Associate London Office 119 -121 Park Lane, Mayfair, London W1K 7AG Tel: 0207 629 4141 |

Registered Name: Comyn and James LLP

Place of registration: England

Registered Number: OC351032

Registered Office Address: Burberry Lodge, 143 Lower Street, Pulborough, RG20 2BX

988 0435 80